Is this donation considered Revenue or Recognition?

Constituent revenue includes only those commitments and payments that were made personally by that constituent, and as a result, the Revenue Summary and Revenue History tabs exclude some important gifts for tax deductibility purposes. The complete view of a donor’s giving history is found in their Recognition Summary and Recognition History tabs. This is where you’ll see, in addition to personal gifts, any gifts made by a spouse or through a third-party such as a DAF, personal business, private foundation, or matching gift company.

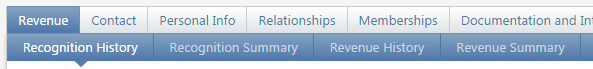

Don’t forget! All tabs and second tier tabs can be rearranged as in the example above. Simply drag and drop each tab in the order of your preference and this option will remain sticky. If you have any questions about revenue and recognition, contact Gift Accounting at 542-4438 (542-GIFT).

Useful Reports

Use caution when viewing information about Household recognition. There are other reports within GAIL that report this information more accurately. You can always reach out to our Reporting team at askit@uga.edu to confirm these totals.

- From a Constituents page > Constituent Credit Total report

- Revenue functional area page > Gift Report by Site/Dept

- Fundraising functional area page > Purpose Search > Donor Information tab to see all donors to a specific fund

Revenue Functional Area Page

· Revenue represents the charitable donations and other non-charitable income your organization receives as payments, pledges, and fees from your constituents. The revenue functional area helps you keep track of the source of revenue, apply revenue to your various fundraising purposes, and run reports that describe your fundraising progress and analyze giving trends.

· Click Revenue located at the top of your screen on the blue functional area bar. From this page you can search for revenue transactions, matching gifts as well as run revenue reports. Security determines what tasks display for individual users.

· The information on this page is categorized into four main categories: Transactions, Processing, Manage matching gifts, and Reports.

o The Transactions category allows you to complete a transaction search which allows you to search for a particular revenue record. This category also contains links to options such as batch entry which lets you enter a pledge batch into the system and batch search which lets you search for a pledge batch record. In addition, pledges, payments, and recurring gifts are entered from this page as well. .

§ A pledge is a Commitment to make a gift or gifts on or before a future date.

§ A payment is a Transaction type representing money, goods, or services received.

§ A recurring gift is a Commitment to make regularly scheduled gifts; may be indefinite.

o The options displayed under the Processing and Manage matching gifts categories are contingent on the level of access you have been granted. Only the office of Gift and Alumni Information Management will have the authority to process gifts.

o The Reports category allows you to run various reports whenever needed to obtain more detailed information that pertains to revenue.

Donor Revenue

· Individual revenue records are divided into three basic sections.

o The top section provides a summary of information about the revenue, such as the payment amount, receipt amount, payment method and acknowledgement status.

o In the middle of the screen you will notice various tabs; each houses particular information which will help you navigate within the revenue record.

§ The Details tab displays on revenue records for payments, pledges, and recurring gifts. The “frames” that display on this page such as details, application details, designations, and/or payment information depend on the particular transaction type.

§ The Benefits tab displays on revenue records for pledges, recurring gifts, and payments. Here, you will find information about the benefits associated with the revenue such as the quantity of the benefit the constituent receives total values of each benefit, and any notes about the benefit.

§ The Matching Gifts tab displays on all records except event registration fees. Here, you will find information about the revenue’s matching gift claims such as the organizations associated with the claim, amount and date of each matching gift claim, and the designations to which revenue is applied. You can also add, edit, and view matching gift claims associated with the payment on this tab.

§ The Letters tab displays on revenue records for pledges, recurring gifts, and payments. Here, you will find information about revenue and tribute acknowledgement letters related to the constituent such as which letters the constituent receives, type of letter, date you ran the acknowledgement process that generated each letter, and date you plan to send each letter.

§ The Attributes tab displays when revenue attributes are configured in the system. Information about the attribute can include the attribute category, the value of the attribute, and any additional comments entered. You can also add and edit revenue attribute information on this page.

§ The Documentation tab allows you to manage, notes, media links, and attachments related to revenue you receive.

§ The GL Distributions tab displays information about the general ledger distribution of the revenue.

§ The Tributes tab displays on revenue records for pledges and payments. Tributes show why the revenue was given such as honor, memory, or celebration of an individual, organization, holiday, etc.

Explorer Bar Menu

o The third section, an explorer bar located on the left hand side of your screen, provides shortcuts and allows you to perform various actions with one click. The actions listed on the explorer bar will be discussed in more detail in later how to videos.

§ The Tasks section allows the Gift Processors to complete tasks such as edit posted payment, edit original amount, change constituent on payment, delete payment, mark payment for re-receipt, etc.

§ The More information section provides a link to revenue and recognition, history, and receipt history.